All new Tesla Model 3 vehicles will now qualify for the full $7,500 federal EV tax credit, according to a change in Tesla’s website.

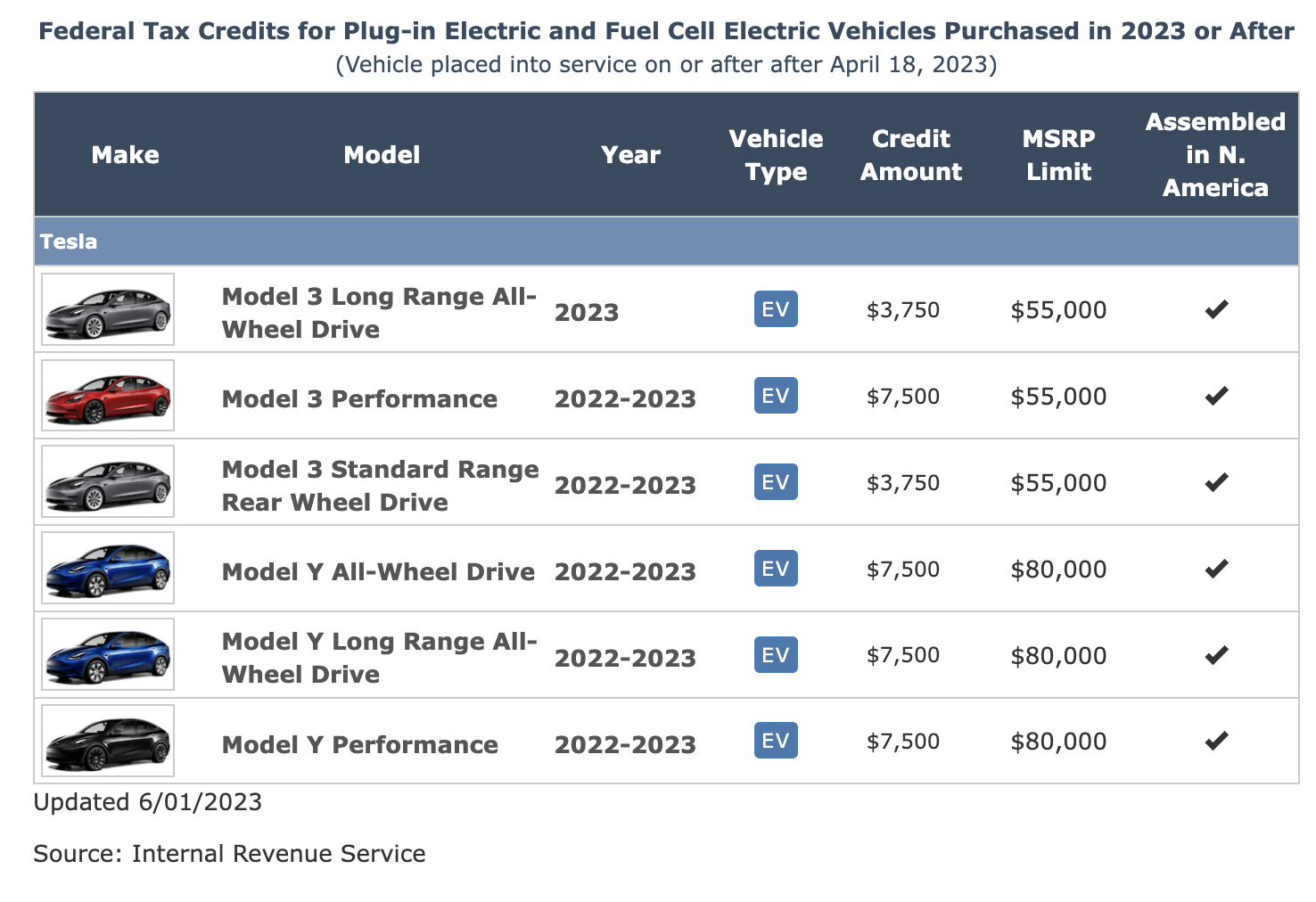

The EV tax credits were mandated by Congress last August as part of the Inflation Reduction Act, with the goal of ending U.S. reliance on China for batteries. The full $7,500 tax credit is broken into two parts. EVs can qualify for half, or $3,750, if 50% of the value of battery components were produced or assembled in North America; the other half requires 40% of the value of critical materials be sourced from the U.S. or another free trade agreement country.

Image Credits: Tesla website

When the tax credits kicked in on January 1, the Treasury Dept. held off on publishing the battery sourcing guidance in order to give EV-makers time to meet the requirements. On April 18, the department began enforcing the critical material sourcing requirement, which led to many vehicle models losing the full tax credits they had been eligible for in the first quarter of the year.

Tesla’s Model 3 saw its full credit slashed in half, but many other automakers — like BMW, Rivian, Volvo and Hyundai — lost their credits entirely.

Now, it appears that all Tesla vehicles will be eligible for the full $7,500 credit. Previously, the only Model 3 that qualified for the full tax credit was the Model 3 Performance. Now, the Model 3 long-range all-wheel drive and rear-wheel drive will also qualify. The Model 3 rear-wheel drive now starts at $32,740 when the tax credit kicks in.

Tesla didn’t say what changed, but CEO Elon Musk retweeted a screenshot of the website that displays the tax credits available for each vehicle. Crucially, the Treasury Dept.’s website has not yet updated to reflect Tesla’s newfound eligibility for tax credits. The department did not yet respond to TechCrunch’s request for comment.

Image Credits: Internal Revenue Service

Read the full article here