insurance.

Stefanie O’Connell Rodriguez

- Stefanie O’Connell Rodriguez is personal finance expert with some tips for car buyers.

- She said shoppers often overlook ownership costs, which include maintenance and insurance.

- Here’s O’Connell Rodriguez’s advice for buying a car, as told to Insider’s reporter.

This as-told-to essay is based on a transcribed conversation with Stefanie O’Connell Rodriguez, a 37-year-old personal finance expert, public speaker, and writer based in New York. She hosts Real Simple Magazine’s “Money Confidential” podcast.

O’Connell Rodriguez has built her brand around “ambition, money, and power.” She has contributed to outlets like Bloomberg, Newsweek, USA Today, and more. The interview has been edited for length and clarity.

I just bought a car in June. There is some relief in sight for car buyers.

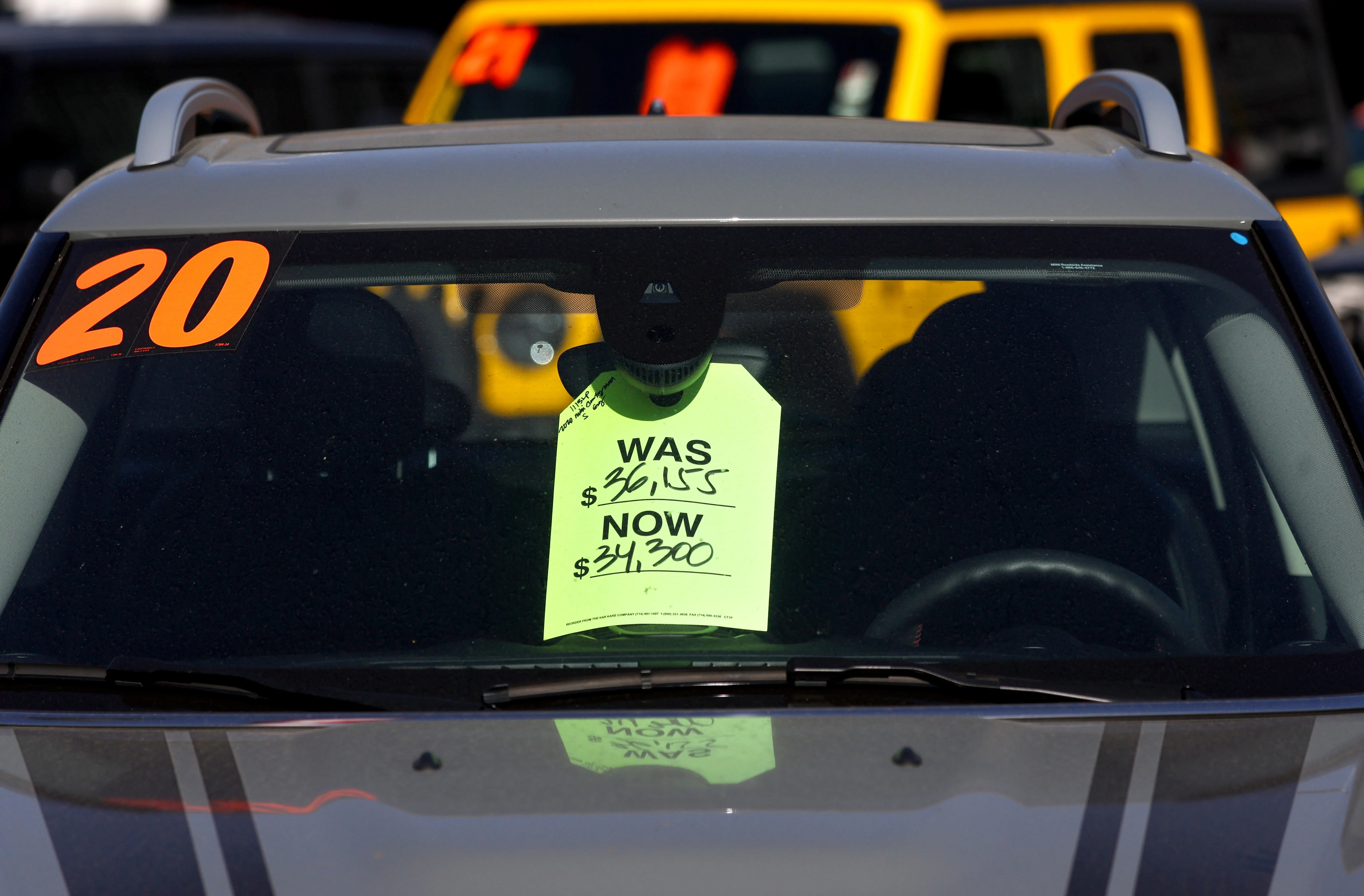

Prices for new vehicles in July were only slightly increased as inventory started to bulk up. Dealers and automakers were offering discounts and incentives. For people in the used car market, there is a little bit of improvement. I don’t think we’re in a pre-COVID market yet, but the data shows us it is getting a little bit better slowly.

That said, take your time shopping. What we see is that that is a good strategy, not just in terms of seeing some relief on pricing, but also just in terms of using that time effectively to actually see: What is the car I’m buying and the cost, not just when I walk out of the dealership, but also on a monthly basis?

Car buyers often focus too much on purchase price and overlook the cost of ownership

To get a better sense of what your ownership price is going to be, I think it really helps to have tools like Kelly Blue Book Service Advisor that tell you, based on your car make and model, what maintenance costs and schedule you can expect depending on your area. Also, who are the service providers? What do they charge for these kinds of services?

Reuters/Umit Bektas

There are unexpected expenses with car ownership — but also a lot you can predict

That’s especially true if you’re doing your research in advance. Obviously every car is different. What it takes to maintain is different, and what it costs to maintain is different.

What we need to do when we’re purchasing a vehicle or thinking about it is: What is this new fixed expense I’m bringing into my budget and committing to for the next, 5, 7, 8, 10 years that I’m going to own this car? What’s my loan interest? What’s my insurance cost? What’s my fuel or my electricity for my EV?

We can research what that maintenance schedule is likely to be and build that into our budget on a monthly basis so that we are prepared when these costs come up, as opposed to finding ourselves constantly playing catch up and overextending ourselves. Thinking of cars as a mostly fixed, but occasionally variable cost is a more strategic and realistic way to plan.

People tend to over-index for their lifestyle

With how often I drive, I might make a different consideration than somebody who’s driving long-hauls every single day. Sometimes we get caught up on sticker price, but I think cost of ownership is so contingent on how the vehicle actually fits into your lifestyle and how you’re going to use it. Think about that as much as you’re thinking about what number is on the hood of the car.

Don’t overlook how a car might depreciate

If you are looking for a car that’s going to maintain its value over the long term, then you probably don’t want to plan for a lot of aftermarket customization that’s going to limit the number of potential future buyers. You don’t want to get a car in a color that very few people want. These are all pieces of the equation to consider.

Joshua Lott/Reuters

Consider delaying your purchase to get a better deal

Don’t rush into purchasing a car. Fluctuations in the market, supply chains, inventory, and interest rates could impact pricing over time.

A car is one of the biggest parts of your budget. It’s one of the things that will determine how much money you have available to spend on the rest of your life expenses for the next however many years you’re going to own the car. So doing your due diligence pays off.

In some cases, delaying a purchase could potentially you thousands of dollars over the life of your vehicle.

While you wait for the right time to buy, try to improve your credit score

If you haven’t taken all these ownership costs into consideration, you might need a little bit more time before you buy.

Improving your credit while you are doing all this research — if it gets you an interest rate that is slightly better, could save you hundreds dollars over the cost of your loan.

If you’re going to be financing, think about doing your due diligence even further of comparing the cost of ownership of different vehicles.

Mario Tama/Getty Images

Always comparison shop at other dealerships

If you’re trying to stay local, consider: how do the prices in my area compare? Doing a little bit of comparison shopping and talking to different dealerships, you might save thousands of dollars, you might save hundreds of dollars. I don’t see a ton of room for a negotiation right now, but that might change as inventory improves.

And finally: don’t assume that the vehicle you’re buying is going to come with the exact same expenses as the last vehicle you owned.

Read the full article here