The United States is in the middle of an electric green wave. Electric vehicle sales are expected to reach 40% of total light vehicle sales by 2030, and some forecasters even see it topping 50% by the end of the decade. While it seems the transition from gas powered cars to electric vehicles is going to be a swift one in the U.S., new polling from Yahoo Finance and Ipsos finds Americans are still very skeptical of that transformation.

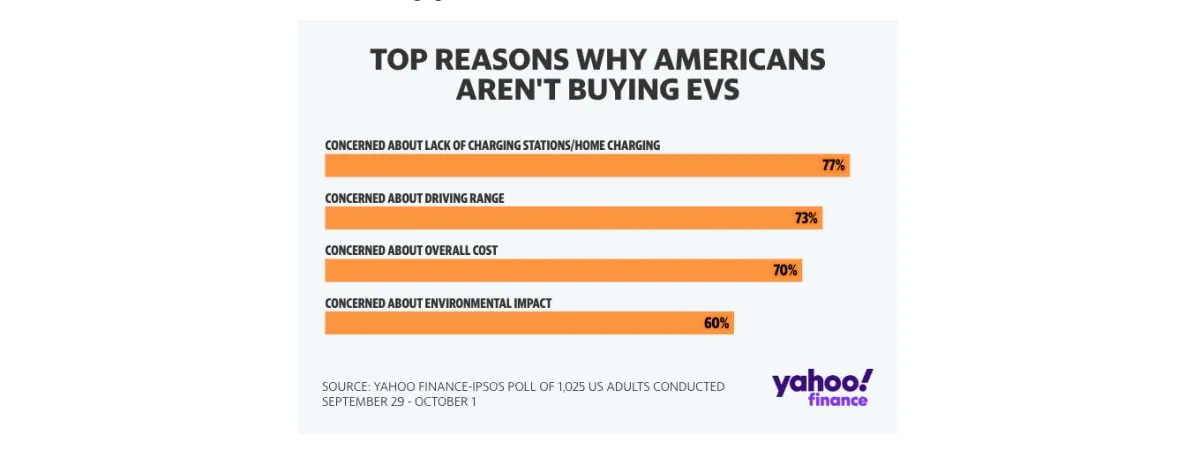

Consumers said concerns such as cost, range, available charging infrastructure, and environmental impact weighed on their decision of whether or not to purchase a fully electric vehicle or plug-in hybrid. Yahoo Finance partnered with Ipsos to conduct a survey asking 1,025 Americans their EV buying preferences. The poll was conducted between Sept. 29 and Oct. 1, 2023.

Overall, 57% of respondents said they were not likely to purchase an electric vehicle (defined as either fully electric or plug-in hybrid) the next time they purchase a vehicle. Only 31% of respondents were likely to purchase an electric vehicle, while 11% said they didn’t know.

Looking at the demographic breakdown of those who would not buy an electric vehicle, 70% of those over the age of 65 would not, along with 60% of respondents that had an annual income below $50,000. In addition, 76% of those that identified as Republicans would likely not buy an electric vehicle.

“I think there’s a lot of different factors,” Stephanie Valdez-Streaty, director of industry insights at Cox Automotive, told Yahoo Finance on what’s holding people back on electric vehicles. “I think it’s price, it’s infrastructure; I think that range anxiety is really infrastructure anxiety.”

When asked what concerns them most about buying an electric vehicle, 70% of respondents in the Yahoo Finance/Ipsos poll were worried about overall cost, 73% were concerned about driving range, and 77% noted lack of charging stations on the road or charging at home.

Despite this, states including California have topped 23% in terms of new EV purchases, whereas the national average is around 8%, according to Cox’s latest US sales report.

Valdez-Streaty says state incentives and education about those incentives are a big factor in the state-by-state differences, with some states better than others at getting the word out. Indeed, while 52% of survey respondents support government incentive programs to encourage EV purchases, only 30% are familiar with programs like the federal EV tax credit.

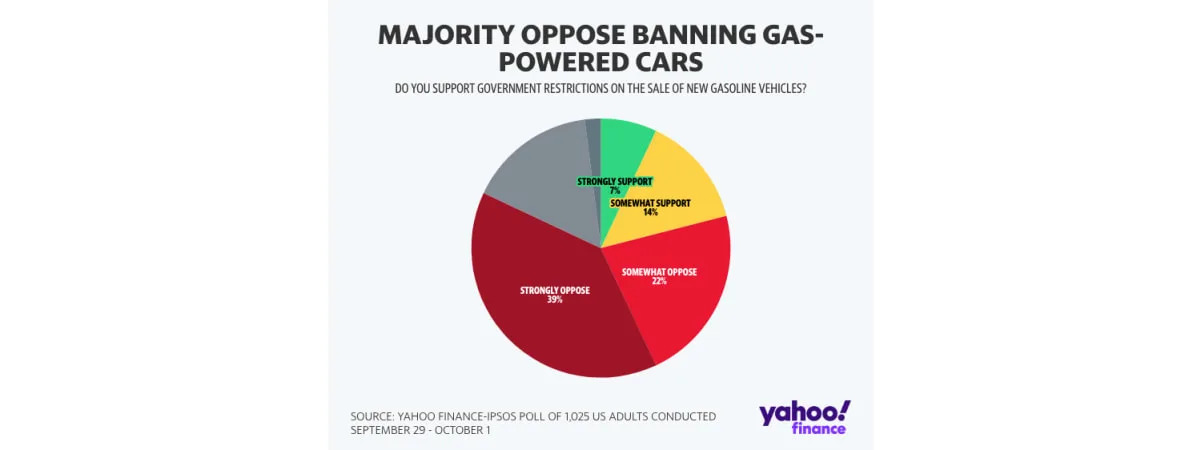

More confusion can be seen when asking about government programs, as is demonstrated by the fact that a majority of those polled said they supported government programs likely to reduce the country’s dependence on fossil fuels (54%), though at the same time nearly two-thirds (61%) opposed restrictions on the sale of new gas-powered cars.

Conversely, of the respondents that said they would likely buy an electric vehicle or hybrid, those in the 35-49 age bracket were most likely to (37%), and 42% of those who made over $100K in income were also likely to purchase an EV as well. From a political affiliation standpoint, 41% of Democrats would purchase an electric vehicle, whereas only 17% of Republicans would.

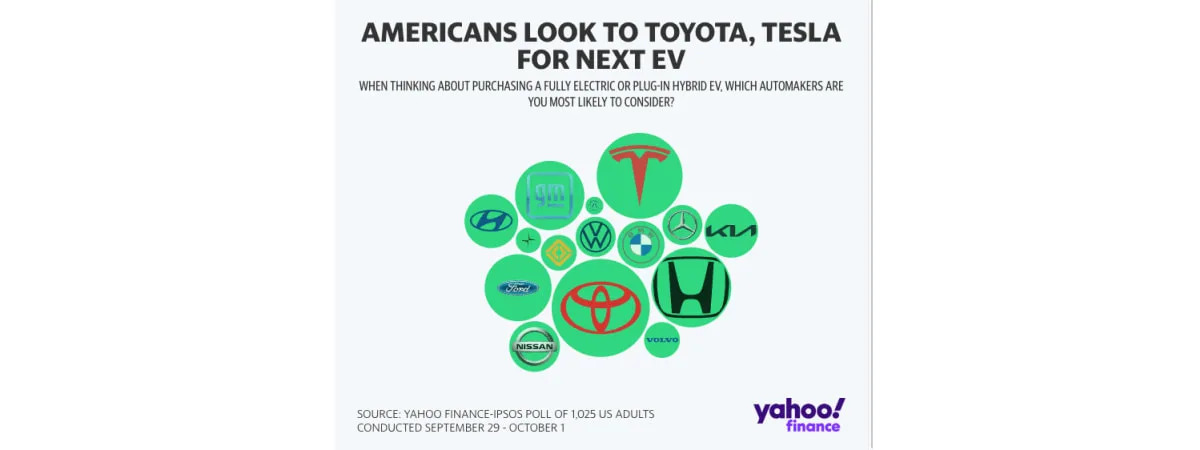

Respondents also had strong preferences for which automakers they would consider purchasing an electric vehicle from if they were to do so. Nearly one-third (30%) would most likely consider Toyota (TM) as their top choice for an electric vehicle, followed by Tesla (TSLA) at 23%, Honda (HMC) at 20%, GM (GM) with 15%, and Ford (F) at 14%.

With a White House goal of 50% EV sales by 2030, policymakers appear to have their work cut out for them in convincing more Americans to purchase EVs.

Valdez-Streaty says pricing is key in making EVs more appealing to US consumers. “Affordability is critical,” she said, noting the federal tax credit is a great incentive, though fewer than a dozen vehicles are eligible at the moment, although that list will expand. “As we start to see more affordable vehicles under the $40,000 price point and more that are eligible for that EV credit, that’s going to be important.”

Indeed, only 20% of buyers are familiar with recent price cuts of electric vehicles made most notably by Tesla and Ford, and the same small percentage (20%) are aware of recent charging deals that, for instance, will expand Tesla’s Supercharging network to EVs made by GM, Ford, Mercedes, and others, addressing another major concern for buyers, which is charging infrastructure and range anxiety.

Pras Subramanian is a reporter for Yahoo Finance. You can follow him on Twitter and on Instagram.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Read the full article here